What are Taxes in Micros Simphony?

Taxes, in general, are sums of money imposed by governments on items sold in restaurants. Taxes in Micros Simphony are usually set up as a percentage, but each country has slightly different rules when it comes to calculating taxes.

There are two main ways of adding taxes to guest checks:

- Add-on tax – primarily used in the United States

- Inclusive Tax – used in the United States, Europe, Latin America, Africa, and Asia. (VAT is a type of inclusive tax)

Add-on tax is calculated by adding a set percentage to the base price of the menu item. For example, if the tax rate is 5%, and we sell a menu item that costs $5, then the bill will show the following:

- Menu Item: $5

- Tax: $0.25

- Total Amount: $5.25

Inclusive tax (VAT) is calculated as part of the cost of the menu item. For example, if the VAT is set to 5%, and we sell a menu item that costs $5, then the bill will show the following:

- Menu Item: $5

- VAT: $0.24

- Total Amount: $5

In general, we find add-on taxes in the United States and Inclusive taxes in the rest of the world, but there are a few key differences we have to be aware of:

- In Europe, we can only use VAT. Only this inclusive tax can be calculated.

- In the US, we can use a combination of Inclusive and Add-on taxes together, and both can be added to the same check.

Breakpoint or Threshold Tax is the third type of tax that can be programmed in Simphony but is not very common. Breakpoint tax is used when the tax rate varies based on the total amount of the menu item. In certain locations, if the price of an item is below $0.50, then the tax rate is just 1%, but over that amount, the tax goes to 6%.

Need help with your Micros Simphopny system? We have a fantastic Facebook community of like-minded individuals that can answer all your questions! Join for free below!

Configuring Taxes in Micros Simphony

When configuring taxes in Micros Simphony, there are two main modules we will work with: Tax Rates and Tax Classes.

- Tax Rates are the percentages that are paid to governmental institutions as set by the law. In some locations, you may have one or multiple institutions to pay taxes to. If your restaurant has to pay a 2% tax to the city and a 4% tax to the state, then your total sales tax will be 6%, but they should be defined as separate rates for accounting purposes.

- Tax Classes are a collection of tax rates. They provide a way to combine multiple tax rates under one category to avoid confusion for the customers.

Configuring Tax Rates in Micros Simphony

Tax rates can be configured at the Enterprise, Property, or Zone levels.

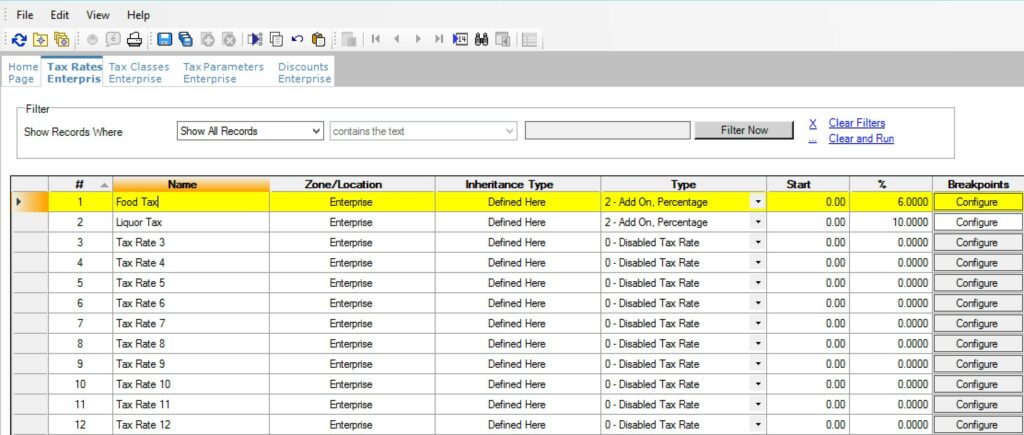

In EMC, select the level you want to configure your taxes and go to the setup tab -> Tax Rates.

- There are a total of 64 tax rate fields available to be used. Change the name of the first field from the default “Tax Rate 1” to a more descriptive name, such as “Food Tax” or “City Tax”.

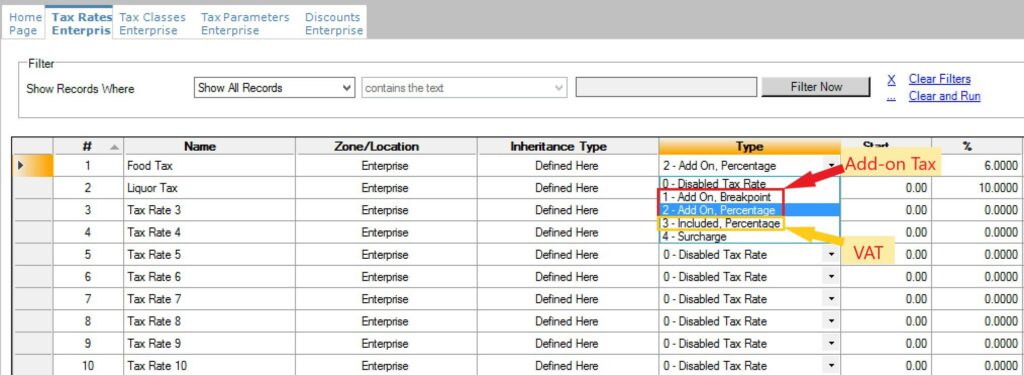

- From the Type, select the correct tax type from the drop-down.

| Type | Description |

|---|---|

0 – Disabled Tax Rate | Select this option if the tax rate is not used anymore. (Legislation changed). |

1 – Add On, Breakpoint | Select this option to calculate the add-on tax using the Breakpoint method. |

2 – Add On, Percentage | Select this option to calculate the add-on tax using the tax percentage rate. |

3 – Included, Percentage | Select this option to calculate the inclusive tax using the tax percentage rate to determine what portion of the sales price is the tax. The inclusive tax applies differently depending on the global VAT (European or United States). Because the tax is included in the price, the tax is backed out of gross sales on reports. |

4 – Surcharge | Select this option to calculate surcharges for items (some cities have surcharges for alcohol and other items) |

- In the % field, enter the tax rate.

- If using breakpoints, select the configure button to add the breakpoints details.

Configuring Tax Classes in Micros Simphony

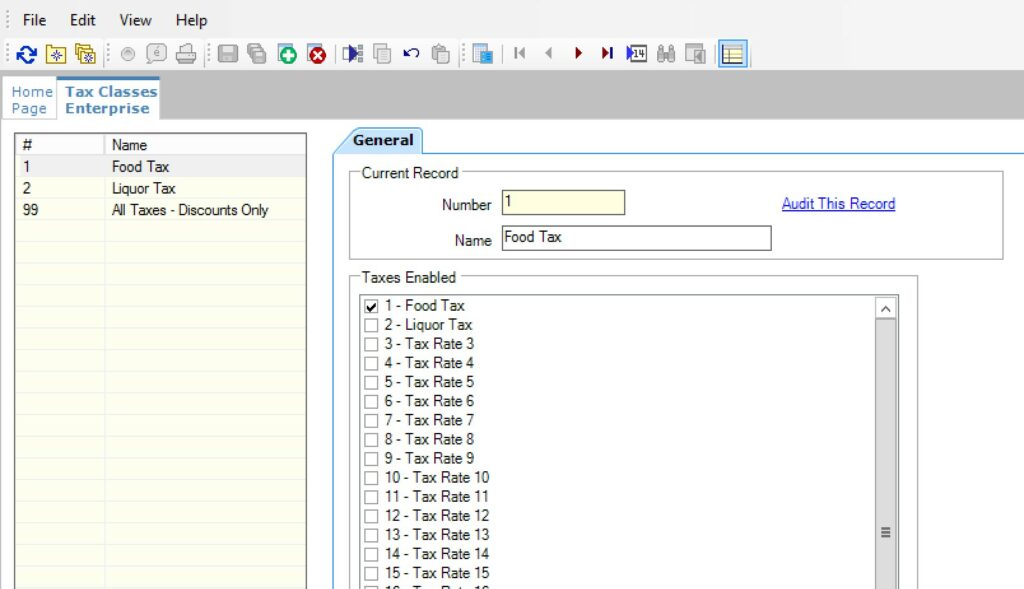

Now that we have our Tax Rates defined, we can assign them to the Tax Classes. Tax Classes are the ones that are printed on the Guest Checks, so be very careful when naming them. It should be descriptive and easy to understand.

In EMC, Tax Classes are also found under the setup tab, just below Tax Rates.

First, add a new record using the Insert Key in the top bar and name it accordingly. Then connect it to the Tax Rate or Rates on the right.

You can assign just one or multiple Tax Rates to each Tax Class as needed.

Configuring Tax Parameters in Micros Simphony

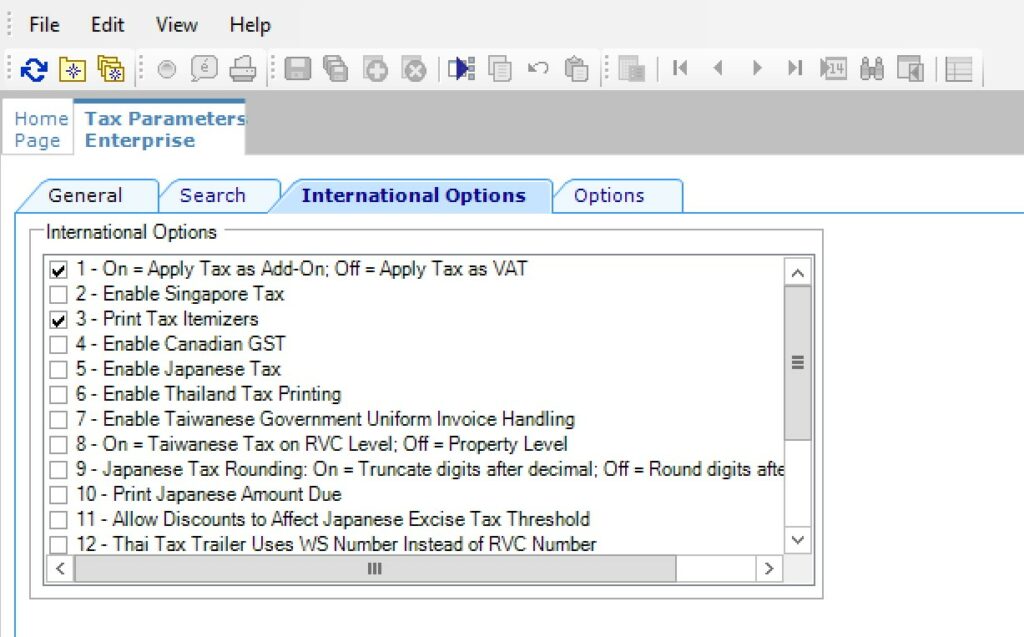

Tax Parameters is where we can find all the different option bits related to taxes. This is where we can define if we are using Add-on Tax or VAT, or specific configurations for each country.

In EMC, we can access Tax Parameters in the Setup tab, just below Tax Classes.

There are two primary tabs in Tax Parameters:

- Internation Options

- Options

Configuring International Options in Tax Parameters

The main option bit in the international options tab is #1 – Apply as add-on tax or VAT.

Besides this option bit, there are several other specific for each country that has a different configuration:

| International Options | Description |

|---|---|

1 – ON = Apply Tax as Add-On; OFF = Apply Tax as VAT | Select this option to treat taxes as an add-on. Deselect this option to treat taxes as a value-added tax (VAT). If you enable VAT, all tax rates in use must be “Included, Percentage.” |

3 – Print Tax Itemizers | Select this option to print tax itemizers on guest checks and receipts. An itemizer is considered a bucket that holds the sale amount of all items taxed at a specific rate. At the end of a transaction, the tax is applied to the subtotal of all items in the bucket. Menu Item Classes are linked to Tax Classes, which in turn, are linked to Tax Rates 1-64. When you link to a tax rate, you are creating an itemizer bucket for that item. You must enable this option for Philippine tax. |

4 – Enable Canadian GST | Select this option to enable Canadian Goods and Services Tax (GST). |

6 – Enable Thailand Tax Printing | Select this option to enable Thai tax options. Starting with the Simphony 19.2.1 release, this option is not in use. |

13 – Truncate Inclusive Taxes | This option applies to all inclusive tax calculations. It determines whether the inclusive tax amount that is calculated is rounded or truncated. For example, if a currency has two decimal places and the tax calculated is 12.005, the rounded tax is 12.01, but the truncated tax is 12.00. |

14 – Print Item Inclusive Tax Total | If the check contains items with inclusive taxes, this option enables the total inclusive tax to print on the guest check. The line prints according to Tax Parameters option 4 – Print Inclusive Tax Totals when 0.00. The inclusive tax amount is the sum of the inclusive taxes for each item on the check. You must also select Tender/Media Printing Options 21 – Print Summary Totals and 24 – Print Inclusive Tax or VAT Lines on Check or Receipt for the inclusive tax totals to print. |

15 – Print Check Inclusive Tax Total | If the check contains items with inclusive taxes, this option enables the total inclusive tax to print on the guest check. The line prints according to Tax Parameters option 4 – Print Inclusive Tax Totals when 0.00. The inclusive tax amount is calculated on the total sales for each tax rate. You must also select Tender/Media Printing Options 21 – Print Summary Totals and 24 – Print Inclusive Tax or VAT Lines on Check or Receipt for the inclusive tax totals to print. |

16 – Print Tax Rate per item | Select to print the applied tax rates for each menu item on guest checks, customer receipts, and the journal. |

17 – Enable Tax Labels | Select to consolidate tax reporting information based on the defined Tax Labels configured under Tax Rates. |

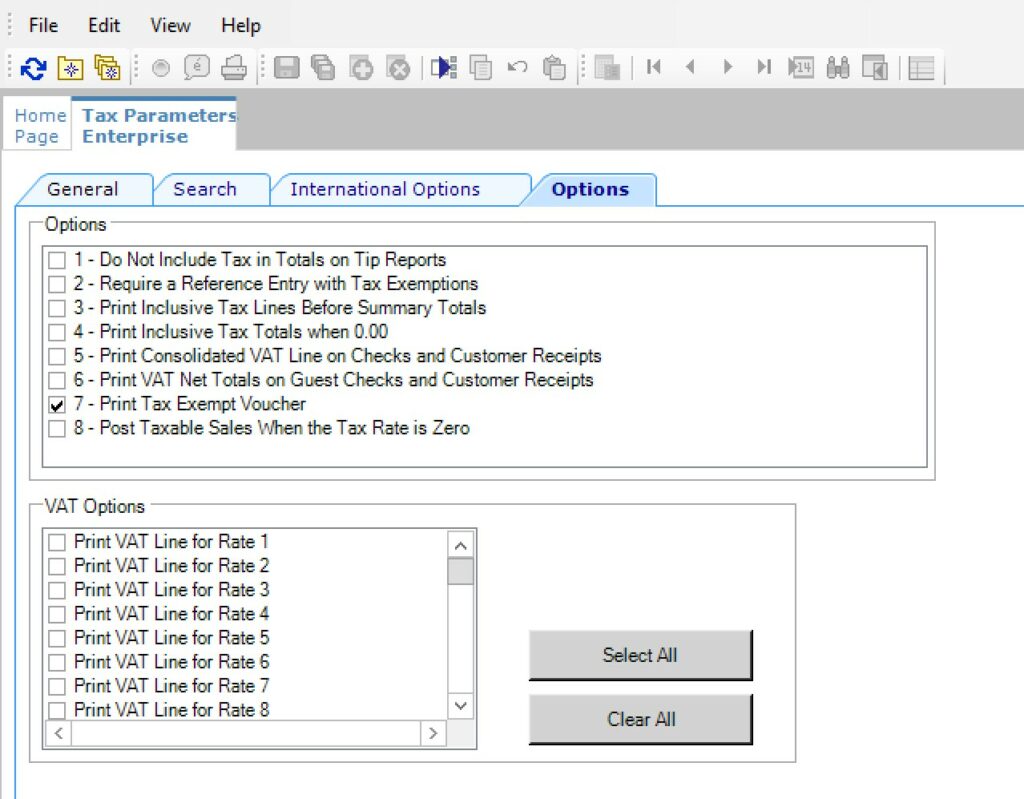

Configuring Options in Tax Parameters

And here are the options bits available in the options tab:

| Options | Description |

|---|---|

1 – Do Not Include Tax in Totals on Tip Reports | Select this option to prevent a transaction’s calculated tax amount from posting to the gross receipts and charged receipts totals on tip reports. |

2 – Require a Reference Entry with Tax Exemptions | Select this option to require workstation operators to enter a reference entry when using an exempt tax function key. |

3 – Print Inclusive Tax Lines Before Summary Totals | Select this option to print inclusive tax totals before summary totals on guest checks and customer receipts. |

4 – Print Inclusive Tax Totals when 0.00 | Select this option to print inclusive totals on guest checks and customer receipts even if the calculated tax due is 0.00. |

5 – Print Consolidated VAT Line on Checks and Customer Receipts | Select this option to print a consolidated VAT line. If you use this option in conjunction with individual VAT line printing, the consolidated line prints last. |

6 – Print VAT Net Totals on Guest Checks and Customer Receipts | Select this option to print a VAT Net Totals line on guest checks and customer receipts. |

7 – Print Tax Exempt Voucher | Select this option to print a voucher when any tax is exempted. The voucher prints when a tax-exempt function key or a tender exempts tax. The voucher prints at the validation printer designated for the workstation. Deselect this option to suppress the printing of a tax-exempt voucher. |

8 – Post Taxable Sales When the Tax Rate is Zero | Select this option to have taxable sales posted to the TAX_DAILY_TOTAL table in Reporting and Analytics when the tax rate is set to 0.00%. The taxable amounts can be used for reporting even though there are no applied taxes. Deselect this option so that taxable sales do NOT post to Reporting and Analytics when the tax rate is set to 0.00%. |

9 – Prorate Tax for Each Combo Meal Menu Item Price as a Percentage of Total Combo Meal Price | Select this option to prorate the menu item price of each combo meal item as a percentage of the total combo meal price in order to apply the correct amount of tax to each item. |

For more Free Content on other Simphony modules, also check out my Micros Training Article.

Applying taxes in Micros Simphony

In Simphony, taxes can be applied to:

- Menu Items

- Discounts

- Service charges

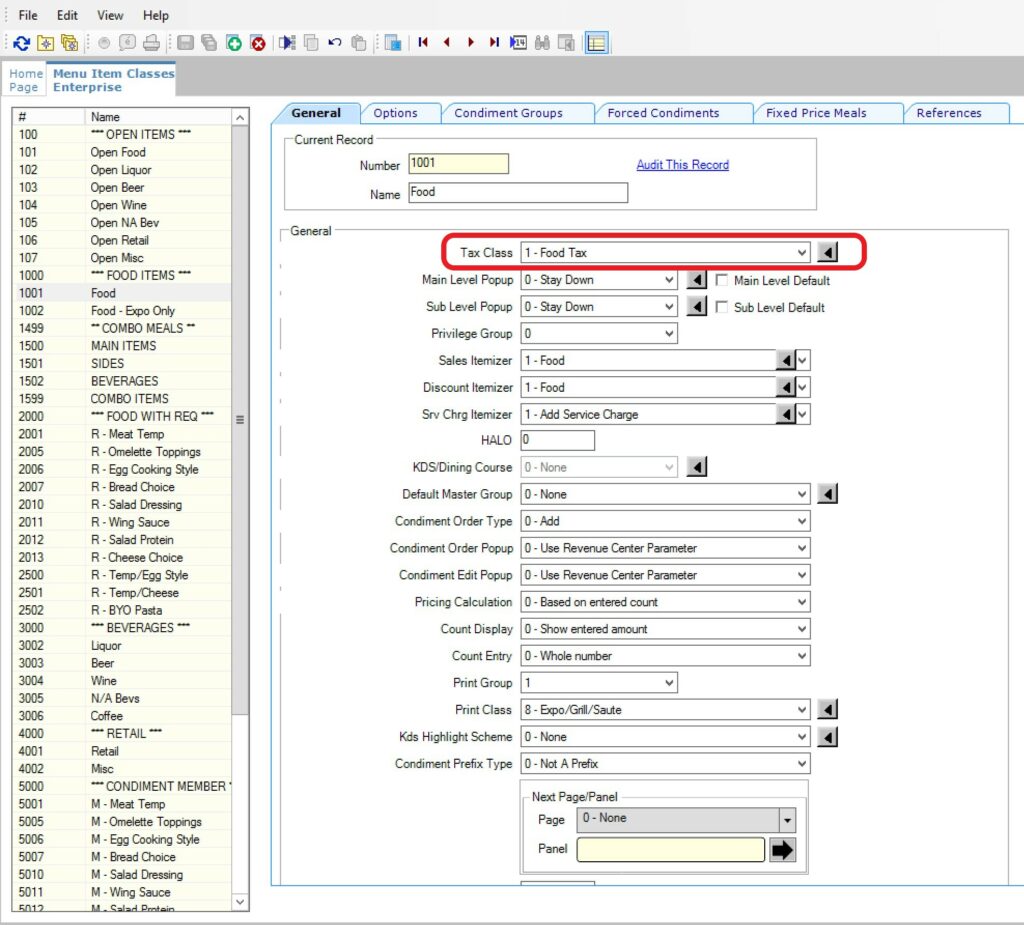

Taxes on Menu Items

Taxes are applied to most menu items, with a few exceptions. We assign the tax class to the menu item classes:

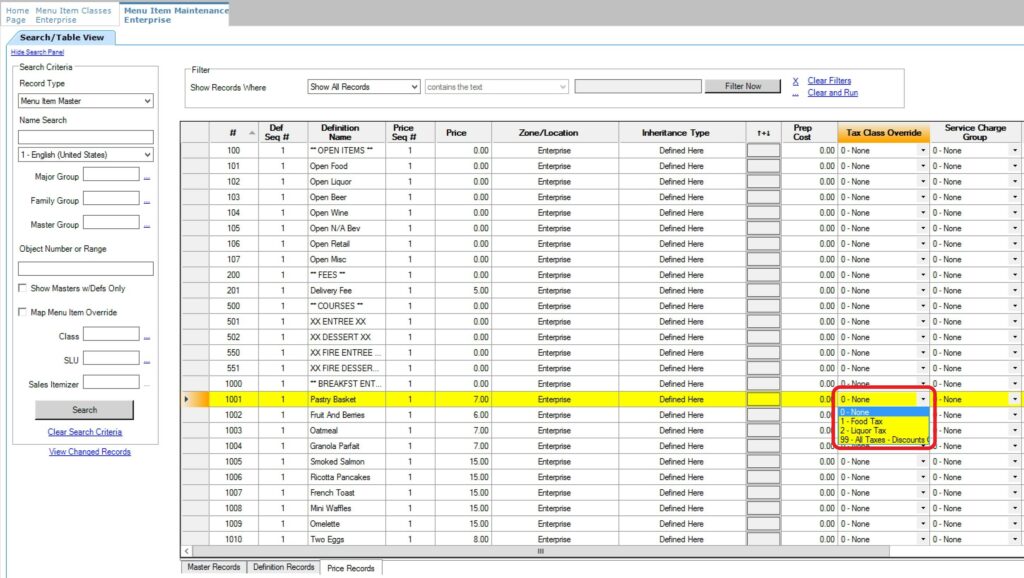

Or the menu item definition individually by using the tax class override field in the prices tab:

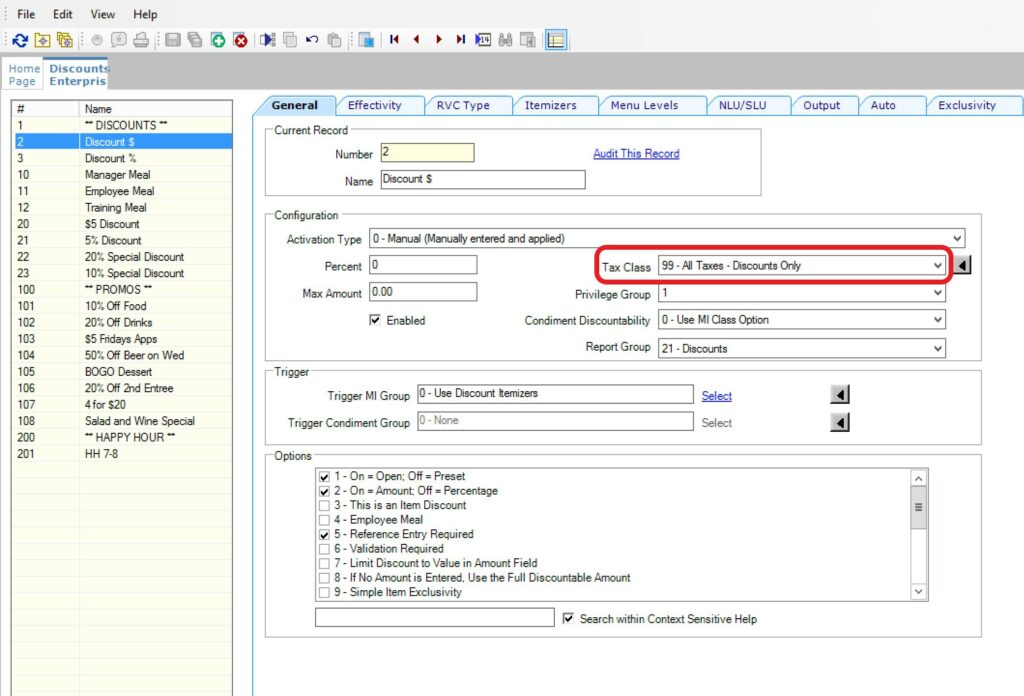

Taxes on Discounts

When a discount is applied to a menu item, in most cases, the customer should pay the tax on the adjusted value of the item (after discount value). This is achieved by adding the tax class to the discounts.

Because different menu items can have different tax rates applied to them, I always create an “All Taxes” Tax Class where all select all the options bits and label it “Discounts Only”, just so there is no confusion. This is the Tax class I use for all my discounts.

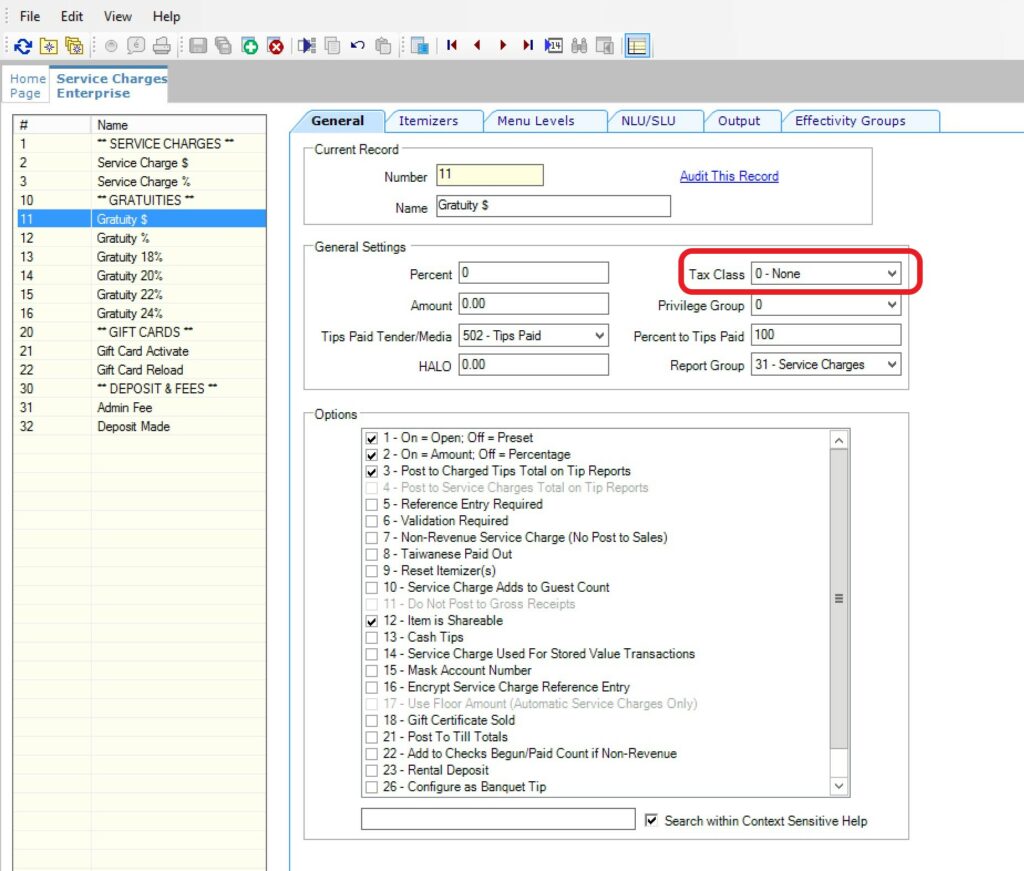

Taxes on Service Charges

Adding Taxes to Service Charges depends on your local legislation. In the United States, Tips and other Gratuities are not Taxed.

In other countries, such as Thailand, for example, if a Tip Service Charge is imposed automatically, then it has to be taxed.

Other Service charges, such as Banquet Fees or Room Service delivery fees might be taxed, so you have to double-check with your accounting department.

If you are looking for comprehensive Simphony Training, we have a complete online course and support platform. More details below.

Configuring Taxes in Micros Simphony

Configuring taxes in Micros Simphony may sound a bit intimidating, but it’s not that complicated. I hope this article will help you if you need to configure or adjust your taxes in your system.

And now it’s your turn!

- Do you have any other tax questions?

- Does your system use add-on tax or VAT?

- Let me know in the comments below!

6 thoughts on “Configure Taxes in Micros Simphony (Add-on, Inclusive, VAT)”

If a site is using VAT/inclusive tax AND has an automatic service charge, is it possible for the service charge to be placed on the “pre-tax” price? So if an item is $100, how do we get Simphony to add tax, to let’s say $84 (pre-VAT) and not the $100?

Thanks!

Hey V,

Yes, in the service charge tab, there is Tax field, select “none” and the service charge will ignore the inclusive tax.

Hello,

I cannot get the taxes to show up on my page design for the life of me.

I have done all the configurations detailed here in addition to going through the Oracle documentation.

Can I get someone to take a look at this with me?

Working on a project and the place wants to launch tomorrow (26 Sept 2024).

Thanks!

You might not have the descriptors properly entered or the tax does not get trigger because it’s not assigned to the menu item classes.

Hi,

Can we change different tax rate for different items and how please

And thank you

Yes, you can create different Tax Rates and then assign them to Tax Classes. The Tax Classes get connected to the menu items via the menu items classes. You will need to assign the new tax classes there and create new Menu Item Classes if needed.